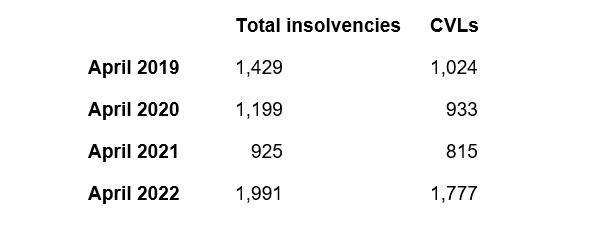

Although showing a slight improvement from March, the number of company insolvencies in April of this year was more than double the number from April 2021. This shows just how important it is to get advice sooner rather than later if your company is experiencing problems.

The majority of insolvencies were creditors’ voluntary liquidations (CVLs):

Figures already available for May show no improvement. The government’s support measures kept insolvencies at bay during the Covid-19 pandemic, but the expected post-pandemic boom has not materialised for many businesses, followed instead by other damaging economic factors such as high inflation, the Ukraine war and supply chain challenges due to continuing Chinese lockdowns.

The insolvency figures suggest many directors lack confidence in their company’s ability to continue trading in the current climate possibly pre-empting later forced closure by bringing forward a difficult decision. Directors who have any doubts about their business are advised to seek advice as soon as possible. There are two tests which can act as a warning sign of insolvency:

- Cash flow test: Signs that a company is failing this test include late payment of suppliers and falling behind with payments to HMRC.

- Balance sheet test: Where a company’s liabilities exceed the value of its assets.

For small businesses and the self-employed, free advice can be obtained from the Business Debtline charity.

Avoiding insolvency

Two recently introduced measures might help a company avoid formal insolvency procedures.

- A moratorium period gives a struggling business a formal breathing space from creditors to explore rescue and restructuring options.

- A new type of restructuring plan can be implemented even if certain classes of creditors vote against it.

Guidance on tell-tale signs of potential insolvency, and how managing an insolvent company incorrectly can lead to personal liability and/or being disqualified as a director, can be found here.

Please get in touch with us sooner rather than later if you believe you may need help.