In late May, the Chancellor announced new measures to counter the rising cost of living, in particular energy prices.

Source: Ofgem.

Initial measures for 2022

In early February 2022, the Chancellor announced a package of measures to reduce the impact of the £693 April 2022 increase in Ofgem’s energy price cap. These were primarily:

- A £150 council tax rebate for those with properties in bands A–D in England, with corresponding funding for Scotland, Wales and Northern Ireland under the Barnett formula;

- An Energy Bills Support Scheme to provide a £200 reduction in utility bills for the year starting in October 2022. This was effectively a loan, to be repaid by £40 a year added to bills from April 2023. The scheme applied throughout the UK apart from Northern Ireland, which again received Barnett formula cash; and

- Extra discretionary funding of £500 million under the Household Support Fund for English councils to allow them to provide support for vulnerable people and individuals on low incomes, again with Barnett money for the UK’s other constituents.

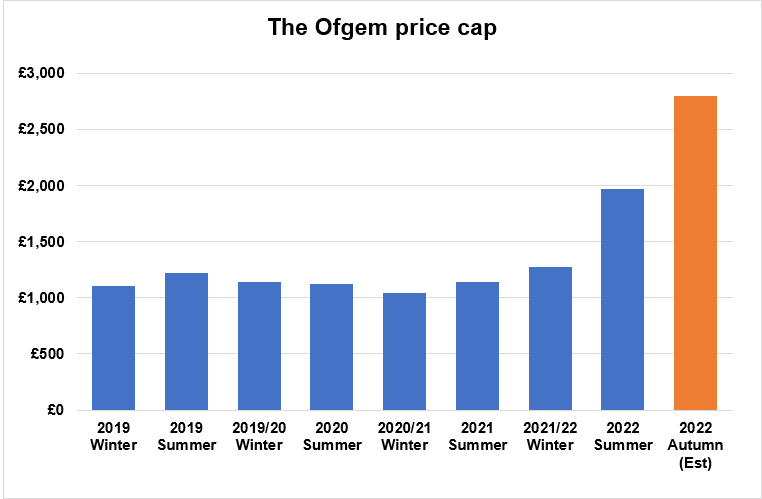

The package, which has had problems with the distribution of the council tax rebates, had a value of about £9 billion. However, with the suggestion from Ofgem that the October price cap will be around £2,800 and inflation already running at 9%, February’s measures looked increasingly inadequate under widespread criticism.

A new helping hand

After many rumours about windfall taxes and whether/where they would be levied, on 26 May Rishi Sunak revealed a new round of cost of living measures, greater in scope than many had expected:

- The reduction provided under the Energy Bills Support Scheme will increase by £200 to £400 and turn into a grant, not a loan, i.e. there will be no clawback from future bills.

- Eight million households throughout the UK on means-tested benefits (e.g. Universal Credit. Working Tax Credit and Pension Credit) will receive a Cost of Living Payment of £650. This will be made in two directly paid instalments, one in July and the second in the autumn. Payments from HMRC for those on tax credits only will follow shortly after each to avoid duplicate payments.

- Another eight million pensioner households eligible for the Winter Fuel Payment (WFP) will be paid a top-up £300 Pension Cost of Living Payment over November and December. Eligibility will be based on being over State Pension age (aged 66 or above) between 19–25 September 2022 and entitled to the WFP

- Six million people in the UK who receive disability benefits (e.g. Disability Living Allowance) will receive a one-off payment of £150 in September.

- The Household Support Fund will receive an additional £500 million for distribution by English councils, with corresponding funding for Scotland, Wales and Northern Ireland under the Barnett formula.

- These payments are not mutually exclusive so, for example, a low-income pensioner could receive a total of £1,150 support (£200 + £650 + £300) in addition to the £350 (£150 + £200) from February’s measures.

Paying the bill

The total cost of the package is put at £15.3 billion. To help finance this there will be a new temporary Energy Profits Levy on oil and gas company profits of 25%, bringing the total tax rate payable by these companies to 65% and raising £5 billion in its first year.

The levy will be phased out if oil and gas prices return to “historically more normal levels” and in any case will end by the start of 2026. To encourage oil and gas companies to invest, the Chancellor will introduce a new Investment Allowance that will mean total tax relief equivalent to 91.25% of new investment.

The levy will not apply to electricity generators, but the Treasury will now urgently evaluate the scale of the extraordinary profits being made by generating companies and consider “the appropriate steps to take”. One interesting non-energy nugget that emerged in the Chancellor’s speech was that “…subject to the Secretary of State’s review, benefits will be uprated by this September’s CPI” and “Similarly, the Triple Lock will apply for the state pension.” That could mean rises of around 10% coming in from April 2023.